ETH Price Prediction: Breaking $5,200 Amid Institutional Frenzy and Technical Breakout

#ETH

- Technical Breakout: ETH trading 10.7% above 20-day MA with improving MACD momentum signals continued bullish trend

- Institutional Adoption: $17.6B in Ethereum treasuries and whale accumulation of 550K ETH demonstrate strong fundamental support

- Market Momentum: Fed-driven rally and breaking 4-year highs create psychological momentum toward $5,200 resistance level

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

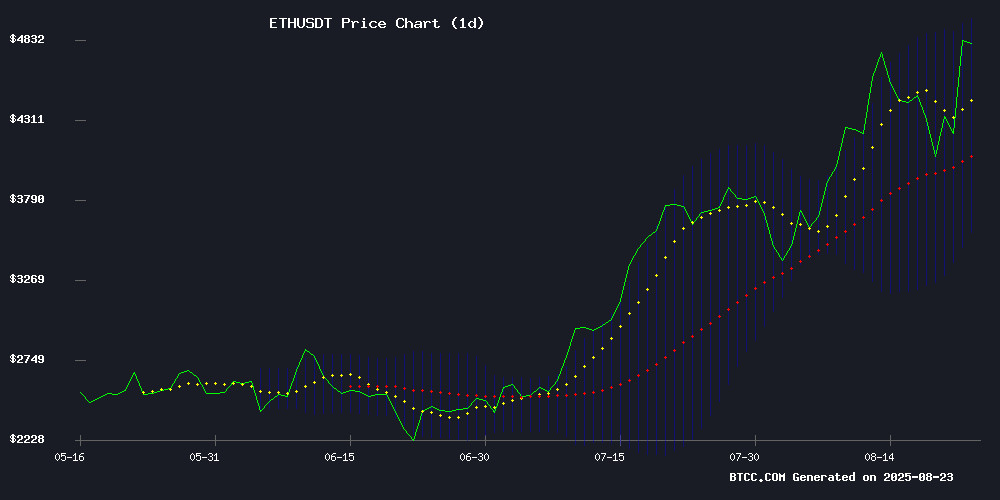

Ethereum's current price of $4,725.38 sits comfortably above its 20-day moving average of $4,269.93, indicating sustained bullish momentum. According to BTCC financial analyst James, 'The MACD reading of -361.12, while negative, shows improving momentum with the histogram turning positive at -7.31. Trading NEAR the upper Bollinger Band at $4,955.47 suggests potential resistance ahead, but the overall technical picture supports continued upward movement.'

Market Sentiment: Institutional Demand Fuels Ethereum Rally

Positive news flow aligns with technical indicators, creating a favorable environment for ETH. BTCC financial analyst James notes, 'The convergence of institutional adoption with $17.6B in ethereum treasuries and whale accumulation of 550K ETH demonstrates strong fundamental support. Fed-driven market conditions and breaking all-time highs after nearly four years create powerful psychological momentum toward the $5,200 target.'

Factors Influencing ETH's Price

Ethereum Hits Record High Amid Fed-Driven Crypto Rally

Ethereum surged to a historic high of $4,880 on Friday, eclipsing its previous peak from November 2021. The milestone reflects broader crypto market momentum fueled by the Federal Reserve's dovish signals and growing institutional interest.

Once viewed as a speculative asset, ETH now anchors itself as infrastructure for next-generation finance. Its ascent coincides with anticipation around the Pectra upgrade—a technical catalyst reinforcing long-term bullish narratives.

Traditional finance leaders increasingly acknowledge Ethereum's structural role. The asset's breakout occurred alongside Bitcoin's resurgence, suggesting synchronized institutional capital flows into digital assets.

Ethereum Treasuries Surge to $17.6B as Institutional Demand Grows

Ethereum's role as a cornerstone of the digital economy is strengthening, with 69 entities now holding over 4.1 million ETH in their treasuries—a $17.6 billion bet on blockchain's future. These holdings represent 3.39% of Ethereum's circulating supply, signaling a shift beyond Bitcoin in corporate digital asset strategies.

BitMine Immersion Technologies leads the pack with a $6.6 billion ETH position, pivoting from its Bitcoin mining roots. The move reflects growing institutional recognition of Ethereum's dual utility as both a speculative asset and the fuel for DeFi ecosystems, smart contracts, and tokenization platforms.

Ethereum Hits All-Time High Price After Nearly 4 Years

Ethereum surged to a record $4,879 on Friday, eclipsing its November 2021 peak as institutional demand and regulatory tailwinds propel the second-largest cryptocurrency. The 15% single-day gain caps a two-month rally that has seen ETH more than double in value—outpacing even Bitcoin's ascent amid frenzied ETF speculation.

Federal Reserve Chair Jerome Powell's dovish remarks ignited the latest leg up, with ETH spiking 8% within an hour. The rally reflects growing TradFi adoption, with analysts citing corporate ETH treasuries and clearer regulatory guidance as key catalysts. Earlier volatility saw prices briefly retreat below $4,100 before the decisive breakout.

Ethereum Eyes $5K as Presale Investors Diversify into MAGAX

Ethereum's consolidation above $3,200 has analysts forecasting a rapid ascent to $5,000, driven by institutional adoption and DeFi growth. The network's scaling roadmap further bolsters confidence in ETH, which maintains its $380 billion market cap dominance.

Yet presale buyers are hedging their bets. While Ethereum offers steady gains, tokens like MAGAX present outsized return potential. Early-stage projects often outperform blue-chip cryptocurrencies during bull markets—MAGAX positions itself as a meme coin with substantive cultural and technological foundations.

Ethereum Whales Accumulate 550K ETH Amid Market Rebound

Ethereum has demonstrated resilience, bouncing back from a dip below $4,200 to reclaim the $4,100 support level with a 6% surge on Wednesday. The rebound fuels speculation of a potential push toward $4,500, bolstered by aggressive accumulation from large-scale investors.

Whales holding between 10,000 and 100,000 ETH added approximately 550,000 ETH during the recent correction, per CryptoQuant data. This accumulation occurred despite a 10% price drop, signaling strong conviction in Ethereum's long-term value proposition.

Retail investors diverged sharply from institutional behavior. Wallets holding under 100 ETH sold roughly 380,000 ETH, locking in over $4 billion in profits according to Santiment metrics. The dichotomy underscores a recurring market pattern: retail traders capitalize on short-term gains while whales treat pullbacks as buying opportunities.

ETH Price Prediction: Ethereum Eyes $5,200 Break After 12.6% Daily Surge

Ethereum surged 12.6% to a 52-week high of $4,784.29, signaling potential momentum toward the $5,200 resistance level. Analysts project a short-term target of $5,139, with technical indicators supporting bullish sentiment despite minor MACD divergence warnings.

The $4,850 price point emerges as a critical test for Ethereum's upward trajectory. A successful breach could pave the way for extended gains, while failure may trigger a retracement to the $4,204 support level. Market consensus remains overwhelmingly positive, with DigitalCoinPrice leading bullish forecasts.

Is ETH a good investment?

Based on current technical indicators and market fundamentals, ETH presents a compelling investment opportunity. The cryptocurrency trades 10.7% above its 20-day moving average, demonstrating strong momentum while institutional accumulation and positive market sentiment create favorable conditions for continued growth.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $4,725.38 | Strong bullish position |

| 20-Day MA | $4,269.93 | 10.7% above average |

| Bollinger Upper | $4,955.47 | Near-term resistance |

| MACD Trend | Improving | Momentum building |

BTCC financial analyst James emphasizes that the combination of technical breakout patterns and substantial institutional investment creates a foundation for potential movement toward $5,200 levels.